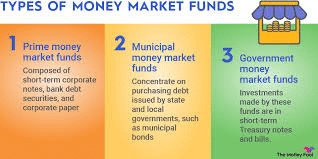

What Are Money Market Funds?

Money Market Funds (MMFs) are a type of mutual fund that invests in short-term, low-risk financial instruments like Treasury bills, commercial paper, and certificates of deposit. They are designed to offer investors a safe and liquid place to store money, often with better returns than a regular savings account.

Why Do People Invest in MMFs?

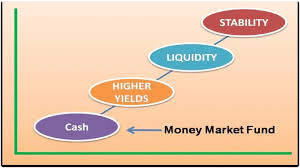

- Safety: MMFs invest in highly-rated, short-term debt, which makes them relatively stable.

- Liquidity: Investors can usually withdraw their money at any time without penalties.

- Better Yields: Compared to traditional savings accounts, MMFs often offer slightly higher interest rates.

How Do MMFs Work?

When you put money into an MMF, the fund manager pools it with money from other investors and uses it to buy low-risk, short-term assets. The fund earns income from interest, which is then passed on to you, the investor. The value of your investment typically stays around $1 per share, with returns coming from earned interest rather than capital gains.

Are They Risk-Free?

No investment is completely risk-free, but MMFs are considered one of the safest options after bank deposits. However:

- They are not insured by the government (unlike FDIC-insured bank accounts).

- During financial crises, MMFs can experience stress, though regulatory changes have made them more secure.

Who Should Consider MMFs?

- Conservative investors looking for a safe place to hold funds temporarily.

- Short-term savers who want quick access to their money.

- Investors with idle cash between bigger investment moves.

Money Market Funds are a practical choice for those who want a stable, low-risk investment that provides better returns than leaving cash in a checking account. While they don’t offer high returns, they can play an important role in a balanced financial plan, especially when safety and liquidity are key.