Kenya has long been hailed as a pioneer in the realm of financial technology, and its latest chapter in this ongoing story is the remarkable rise of digital banking and mobile money. What was once a pioneering innovation in the form of M-Pesa has now blossomed into a full-fledged digital banking ecosystem that is rapidly transforming the country’s economic landscape, empowering millions of Kenyans and driving financial inclusion like never before.

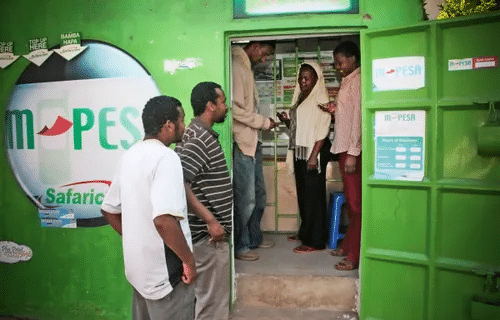

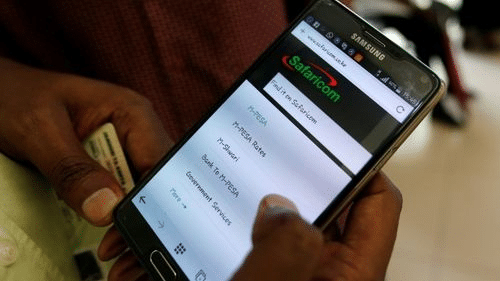

The cornerstone of this digital banking revolution is the ubiquitous M-Pesa platform, launched by Safaricom in 2007. Initially envisioned as a simple mobile money transfer service, M-Pesa has since evolved into a comprehensive financial services hub, allowing users to not only send and receive money, but also save, borrow, and make payments with the tap of a button on their mobile devices.

“M-Pesa has been a game-changer for Kenya,” says James Mwangi, the CEO of Equity Bank, one of the country’s leading financial institutions. “It has brought the convenience of digital financial services to the fingertips of millions of Kenyans, many of whom were previously excluded from the formal banking system. This has had a profound impact on economic empowerment and financial inclusion across the country.”

Indeed, the statistics speak for themselves. As of 2022, M-Pesa boasts over 30 million active users in Kenya, accounting for a staggering 99% of the country’s adult population. The platform processes an average of over 61 million transactions per day, worth a combined value of $26 billion, making it one of the most widely used and successful mobile money services in the world.

But the impact of digital banking in Kenya goes far beyond just M-Pesa. The country has witnessed a proliferation of other digital banking platforms, each offering a unique set of services and catering to the diverse needs of the Kenyan consumer. From seamless mobile banking apps to innovative microlending solutions, the digital banking landscape in Kenya is thriving, and it is driving remarkable changes in how people manage their finances.

“The rise of digital banking has been a true democratization of financial services in Kenya,” says Esther Ndeti, a financial inclusion expert at the Central Bank of Kenya. “It has broken down the barriers that traditionally kept many Kenyans, especially those in rural and underserved areas, from accessing basic banking services. Now, anyone with a mobile phone can easily open an account, transfer funds, and even access credit, all from the comfort of their own homes.”

This increased financial inclusion has had a ripple effect on the broader Kenyan economy. By providing access to digital financial tools, digital banking has empowered entrepreneurs, farmers, and small business owners to grow their ventures, invest in their communities, and contribute to the country’s overall economic development.

“Digital banking has been a game-changer for my business,” says Fatuma Aden, a small-scale produce seller in Nairobi. “I used to rely on cash, which was cumbersome and insecure. Now, with my mobile money account, I can easily accept payments, track my sales, and even access loans to expand my operations. It’s made a huge difference in my ability to grow and thrive.”

The impact of digital banking extends beyond the individual level, with the technology also playing a crucial role in driving financial innovation and fostering a more dynamic and resilient financial ecosystem in Kenya. The country’s thriving fintech sector, which includes startups, tech giants, and traditional banks, is constantly developing new products and services to cater to the evolving needs of Kenyan consumers and businesses.

“Kenya has become a hub for financial technology innovation, and digital banking is at the heart of that,” says Jack Ngare, the managing director of the Microsoft Africa Development Center in Nairobi. “The level of collaboration and cross-pollination of ideas between the tech and financial sectors is truly remarkable, and it’s pushing the boundaries of what’s possible in terms of financial inclusion and economic empowerment.”

As Kenya continues to embrace the digital banking revolution, the country’s policymakers and regulators are also working to ensure that the growth of this sector is sustainable and equitable. Initiatives such as the Central Bank’s regulatory sandbox, which allows fintech startups to test their products in a controlled environment, and the development of a robust digital ID system, are helping to foster a secure and innovative digital finance landscape.

“The future of banking in Kenya is digital, and we are committed to ensuring that this transition is done in a way that benefits all Kenyans,” says Patrick Njoroge, the Governor of the Central Bank of Kenya. “By harnessing the power of technology and encouraging innovation, we can continue to drive financial inclusion, spur economic growth, and solidify Kenya’s position as a global leader in the digital finance revolution.”