In today’s dynamic economic landscape, securing financial stability has become a top priority for individuals seeking long-term prosperity. While traditional avenues of income, such as employment, remain essential, an increasing number of people are turning to investments as a supplementary and even primary source of income. Understanding how investments work, their role in fostering financial stability, and their myriad advantages can empower individuals to make informed decisions about their financial future.

How Investments Work

Investing involves committing money with the expectation of earning a return on that capital over time. This can be achieved through various asset classes, including stocks, bonds, real estate, mutual funds, and alternative investments like commodities or cryptocurrencies. Each investment vehicle carries its own level of risk and potential return, allowing investors to tailor their portfolio to match their risk tolerance and financial goals.

The fundamental principle of investing revolves around the concept of compounding returns. By reinvesting earnings, investors can harness the power of compounding to generate exponential growth in their wealth over time. This means that the earlier one starts investing, the greater the potential for long-term wealth accumulation.

Financial Stability Through Investments

Investments play a crucial role in fostering financial stability for several reasons

Diversification: Investing in a diversified portfolio spreads risk across multiple assets, reducing the impact of adverse events on overall returns. Diversification helps cushion against market volatility and safeguards against the failure of any single investment.

Income Generation: Many investments, such as dividend-paying stocks, bonds, or rental properties, generate regular income streams, providing a steady source of cash flow independent of traditional employment. This passive income can supplement earnings, support lifestyle expenses, or be reinvested for further growth.

Wealth Preservation and Growth: Investments offer the potential for capital appreciation, allowing individuals to preserve and grow their wealth over time. By staying ahead of inflation, investments help maintain purchasing power and ensure financial security in the face of rising living costs.

Tax Efficiency: Certain investment vehicles, such as retirement accounts or tax-advantaged accounts like ISAs or 401(k)s, offer tax benefits that enhance overall returns. By strategically utilizing tax-efficient investment strategies, investors can minimize their tax liability and maximize after-tax wealth accumulation.

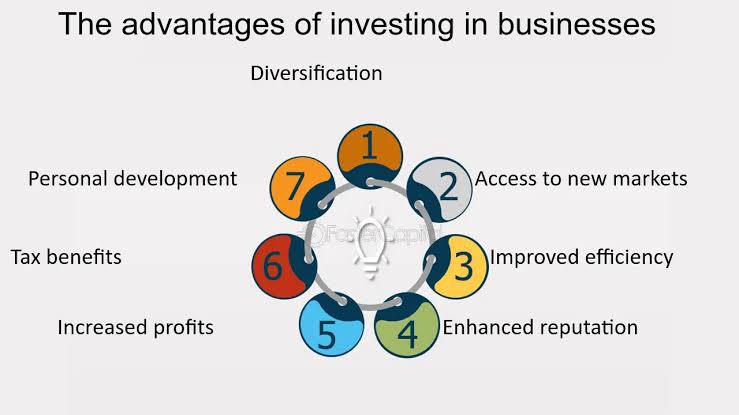

Advantages of Investments

Investments offer a plethora of advantages that contribute to financial well-being

Flexibility: Investors have the flexibility to tailor their portfolios to align with their financial goals, risk tolerance, and time horizon. Whether aiming for short-term gains or long-term wealth accumulation, there are investment options to suit every need.

Passive Income: Many investments, such as rental properties, dividend stocks, or interest-bearing bonds, generate passive income streams that require minimal ongoing effort once established. This passive income can provide financial freedom and lifestyle flexibility, allowing individuals to pursue other interests or ventures.

Wealth Accumulation: Through the power of compounding returns, investments facilitate the accumulation of wealth over time. Even small, consistent contributions can grow substantially over the years, leading to significant financial milestones and goals.

Hedging Against Inflation: Certain investments, such as real estate or commodities, serve as hedges against inflation by preserving purchasing power and maintaining the value of assets in real terms. This protection against inflation ensures that wealth remains resilient in the face of economic uncertainties.

Investments represent a potent tool for achieving financial stability and long-term prosperity. By understanding how investments work, leveraging diversification, and harnessing the advantages they offer, individuals can build robust portfolios that generate income, preserve wealth, and safeguard against financial uncertainties. Whether aiming to supplement current income, prepare for retirement, or achieve specific financial goals, investing remains a cornerstone of financial success in an ever-changing economic landscape.