As Kenya’s economy continues to navigate the challenges of the post-pandemic era, the country’s latest Finance Bill has sparked a flurry of discussions and debates, particularly among the small business community. Introduced in June 2022, the Finance Bill aims to reshape the country’s tax landscape, introducing a range of measures that could have far-reaching implications for entrepreneurs and small-to-medium enterprises (SMEs).

At the heart of the controversy is the proposed increase in the Value-Added Tax (VAT) rate, which is set to rise from 16% to 18%. This change has raised concerns among small business owners, who fear that the additional tax burden could further strain their already tight profit margins.

“As a small business owner, every penny counts,” explains Fatima Ndungu, the founder of a local artisanal soap company in Nairobi. “We’re already grappling with the rising costs of raw materials, utilities, and employee salaries. An increase in VAT is just going to make it that much harder for us to stay afloat.”

Ndungu’s sentiment is echoed by many of her peers, who argue that the Finance Bill’s provisions fail to account for the unique challenges faced by Kenya’s thriving small business sector. According to a recent survey by the Kenya National Chamber of Commerce and Industry (KNCCI), nearly 60% of SMEs reported a decline in revenue over the past year, with the majority citing the economic fallout of the COVID-19 pandemic as the primary driver.

“Small businesses are the backbone of Kenya’s economy, contributing significantly to job creation and economic growth,” says KNCCI President Richard Ngatia. “By increasing the tax burden on this crucial sector, the government risks stifling innovation, hampering entrepreneurship, and undermining the very foundations of our economic recovery.”

However, the government maintains that the Finance Bill’s measures are necessary to shore up Kenya’s fiscal position and fund critical development projects. The country’s Treasury Secretary, Ukur Yatani, has argued that the VAT increase will generate an additional 27 billion Kenyan shillings (approximately $225 million) in revenue, which will be channeled into improving infrastructure, healthcare, and education.

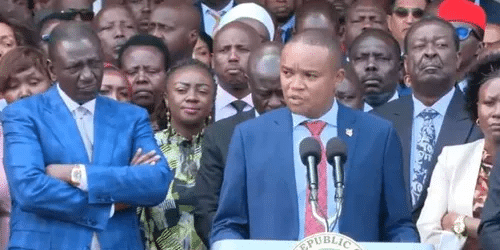

“We understand the concerns of the small business community, but the reality is that we are facing significant fiscal pressures,” Yatani said in a recent press conference. “This Finance Bill is a necessary step in ensuring the long-term sustainability of our economy and our ability to deliver vital public services to all Kenyans.”

Despite the government’s assurances, many small business owners remain unconvinced, arguing that the burden should be more equitably distributed across the economy. Some have called for the introduction of targeted tax relief or incentive programs to help offset the impact of the VAT increase on SMEs.

“If the government is genuinely committed to supporting small businesses, then they need to provide us with the tools and resources to thrive,” says Ndungu. “That could mean lowering the VAT rate for small businesses, or offering tax credits and subsidies to help us invest in growth and innovation.”

As the debate over the Finance Bill continues to unfold, small business owners in Kenya are anxiously awaiting the final outcome, which could have significant implications for the country’s economic landscape. For Ndungu and her colleagues, the stakes are high, but they remain determined to weather the storm and emerge stronger on the other side.

“We’re not going to give up without a fight,” she says. “Small businesses are the lifeblood of this country, and we’ll do whatever it takes to ensure that our voices are heard and our needs are met. The future of Kenya’s economy depends on it.”