Since its inception in 2009, the ride of digital money, more colloquially known as cryptocurrencies, has been nothing short of seeing it all. In fact, the story of Bitcoin spans from stratospheric valuations through regulatory crackdowns and beyond into an era of amazing technological breakthroughs that captured global attention. This blog unravels the story of their rise, explores the factors leading to falls, and examines what the future may hold.

The Rise: A New Financial Revolution

First cryptocurrencies were developed as a reaction to traditional financial systems, which were deemed inefficient or ineffective in a particular way. Bitcoin was invented by Satoshi Nakamoto-an anonymous one-and was a digital peer-to-peer currency decentralized and underpinned by blockchain technology. Contrary to fiat currencies, which are backed and controlled by central banks, Bitcoin rests on the very principle of a trustless system; that is, each transaction is scanned by a distributed node network, which makes it secure and open.

The attractiveness of cryptocurrencies crept in because they promised:

Financial Inclusion: “Banking services provided to the section of population that is unbanked”.

Transparence and security: immutable transaction ledgers.

Centralization: Allowing the elimination of middlemen, like banks, and reducing the cost of transactions.

By 2017, they were shooting up to almost US$20,000 a coin, with thousands of other alternative cryptocurrencies such as Ethereum, Litecoin, and Ripple entering the market. The idea of Ethereum using smart contracts opened the chain toward advanced applications above just value transfer, including DeFi, tokenization, and NFTs.

The Fall: Crashes and Criticisms

The fact remains that despite the initial euphoria, virtual currencies have faced critical challenges:

Volatility and Speculation

Cryptocurrency prices are notoriously volatile. Bitcoin, for example, spectacularly surged to an all-time high of US$69,000 in 2021, only to drop below US$20,000 less than a year later. Such instability has been made worse by speculative trading, which responds to hype rather than fundamentals-a factor that has discouraged mainstream adoption.

Uncertainty in regulation

Different governments have tried to grapple with how to regulate cryptocurrencies, ranging from El Salvador’s adoption of Bitcoin as legal tender to China’s outright ban. Unclear and murky regulations often dent investor confidence and hinder businesses.

Frauds and Scams

However, the anonymous and decentralized nature of cryptocurrencies has also made them a target in terms of cybercrime. From Ponzi schemes to fraudulent initial coin offerings, exchange hacks have seen billions lost, giving the industry a bad name in the process.

Environmental Concerns

The energy-intensive process of cryptocurrency mining, especially for proof-of-work networks like Bitcoin, has faced criticism over its environmental impact. Countries and organizations have sounded the alarm over the carbon footprint from mining, raising debates on how best to make the practice sustainable.

The Future: Reasons to be Optimistic

Amid Chaos Although there have been setbacks with cryptocurrencies, their potential impact on changing the global financial system is immense. Following are some trends that may shape the future of digital currencies:

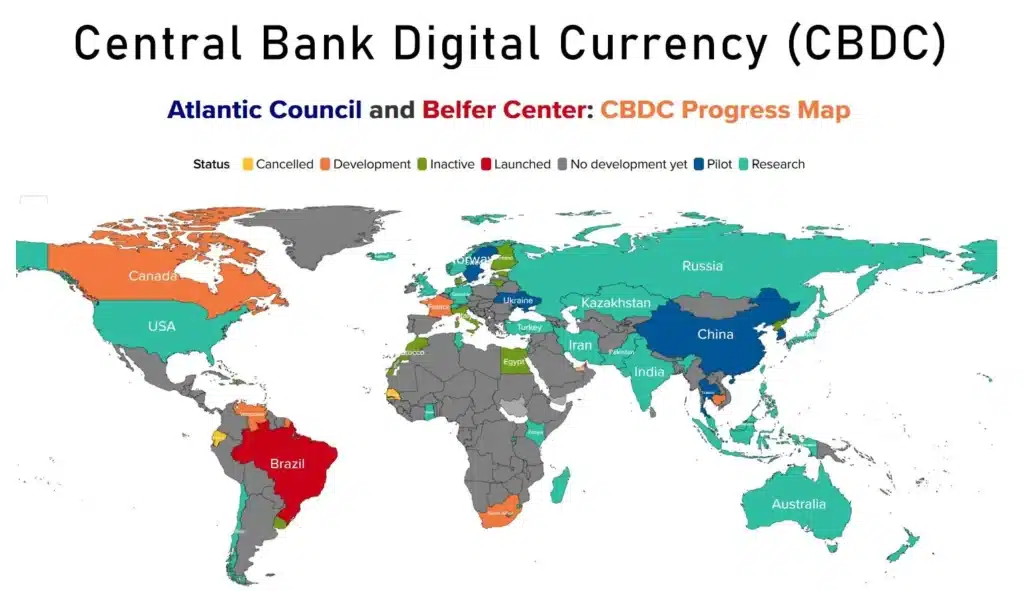

Emergence of Central Bank Digital Currencies

Because of this fact, through the usage of blockchain technology, governments and central banks are now perusing ways of making CBDCs to retain their grip on monetary policy. Great examples include China’s Digital Yuan and the Digital Euro from the European Central Bank. Such currencies strive to combine advantages of cryptocurrencies with traditional money stability.

Regulatory Frameworks

Clear-cut regulations undertaken by the crypto industry are very important for its development. Frameworks on anti-money laundering, know-your-customer protocols, and investor protection can help engender trust and drive institutional adoption.

Innovations in Blockchain Technology

New technologies, such as proof-of-stake mechanisms, are the Fallout of concerns over energy consumption. Ethereum, in that respect, has shifted to PoS and therefore massively reduced its carbon footprint-a good precedent for other networks.

Decentralized Finance (DeFi) and Web3 DeFi applications continue getting updated with lending and borrowing services, extending to yield farming sans intermediaries. And here comes the decentralized internet, Web3; it is gaining traction quite aptly-your key cryptos light up the diverse ecosystems lining its floor. Traditional Finance Integration Major financial players are gradually opening themselves to cryptocurrencies. Giants such as Tesla, Visa, and PayPal have made integrations toward crypto payments, while banks study how they might offer custody for digital assets.

Conclusion:

A Journey of Transformation Cryptocurrencies represent one of the most transformational innovations of the 21st century, an upsetting factor to typical notions of money, finance, and technology. Though the road has been fits-and-starts tumultuous, the underlying promise of digital currencies can never be denied. As the industry matures, the focus needs to shift to sustainability, inclusivity, and collaboration with, not against, the regulators. Whether cryptocurrencies will be the future grease of global finance, or a niche alternative-undeniably, they are about to shape the future of money. The saga of digital currencies is anything but over-the next chapters will be even more chaotic, innovative, and transformative.