Kenya’s economic landscape has undergone significant transformations in recent years, with one increasingly prevalent trend being the leasing of major local businesses to foreign entities. While this strategy has been touted as a means of attracting investment and boosting economic growth, the implications for Kenya’s economy have been complex and multifaceted.

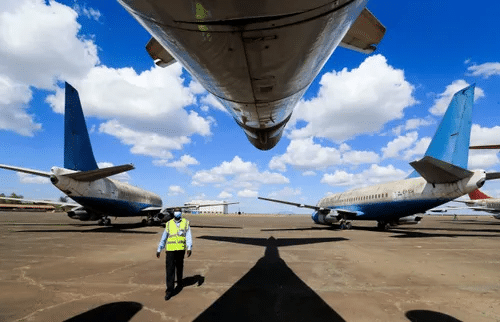

Perhaps one of the most high-profile examples of this phenomenon is the management of the Jomo Kenyatta International Airport (JKIA), Kenya’s busiest aviation hub. In 2017, the Kenyan government entered into a 30-year concessional agreement with the French company Groupe ADP to manage and operate the JKIA. This move was aimed at modernizing the airport’s infrastructure, improving efficiency, and enhancing its capacity to handle the growing number of passengers and cargo.

On the surface, the JKIA concession appears to be a positive development for Kenya’s economy. Groupe ADP’s expertise and resources have indeed enabled significant upgrades to the airport’s facilities, including the construction of new terminals, the expansion of parking areas, and the implementation of advanced security and passenger processing systems. These improvements have contributed to a more seamless travel experience for both domestic and international travelers, bolstering Kenya’s reputation as a premier tourism and business destination.

Moreover, the concession agreement has generated substantial revenue for the Kenyan government, with the country reportedly earning over $500 million from the deal in the first three years alone. This influx of funds has provided a much-needed boost to the government’s coffers, allowing for increased investment in public services, infrastructure development, and other critical areas of the economy.

However, the long-term implications of this leasing arrangement have raised concerns among Kenyan policymakers and the general public. One of the primary issues is the potential loss of control and sovereignty over a strategically important national asset like the JKIA. By ceding management and operational responsibilities to a foreign entity, Kenya runs the risk of becoming overly dependent on the decisions and priorities of Groupe ADP, which may not always align with the country’s best interests.

Furthermore, the leasing of the JKIA has raised questions about the equitable distribution of the economic benefits. While the Kenyan government has touted the revenue generated from the deal, there are concerns that a significant portion of the profits may be repatriated back to France, rather than being reinvested into the local economy. This could potentially undermine the multiplier effect that such investments are expected to have, limiting the overall economic impact on Kenyan businesses and communities.

Another concern is the potential impact on employment and labor rights. As Groupe ADP assumes control of the JKIA, there are worries that the company may introduce new work practices, policies, and management structures that could adversely affect the job security and working conditions of Kenyan employees. This could lead to labor unrest, strikes, and other forms of industrial action, which could in turn disrupt the smooth operation of the airport and the broader economy.

These issues are not unique to the JKIA concession; they are representative of the broader challenges that Kenya faces as it increasingly turns to foreign entities to manage and operate its strategic assets. From the privatization of state-owned enterprises to the granting of long-term leases on public land, the Kenyan government’s reliance on foreign investment and expertise has sparked debates about the balance between economic development and national sovereignty.

As Kenya navigates these complex issues, it will be crucial for policymakers to strike a delicate balance between attracting foreign investment and ensuring that the economic benefits are equitably distributed and reinvested in the local economy. This may involve renegotiating existing agreements, implementing stronger regulatory frameworks, and fostering greater transparency and accountability in the management of such deals.

Ultimately, the leasing of local businesses to foreigners is a double-edged sword for the Kenyan economy. While it can bring much-needed capital, expertise, and infrastructure upgrades, it also carries the risk of undermining national control, limiting the distribution of economic gains, and potentially exacerbating social and political tensions. As Kenya continues to grapple with these challenges, it will be crucial for policymakers to prioritize the long-term interests of the country and its citizens.